Car Finance is worth £40billion in the UK – but some loans may have been mis-sold

Many British drivers could have been mis-sold loans to purchase their cars, causing them to pay more than they needed to for their vehicles.

The car finance industry in the UK may be facing a mis-selling scandal if it’s found the terms have not been properly explained to drivers.

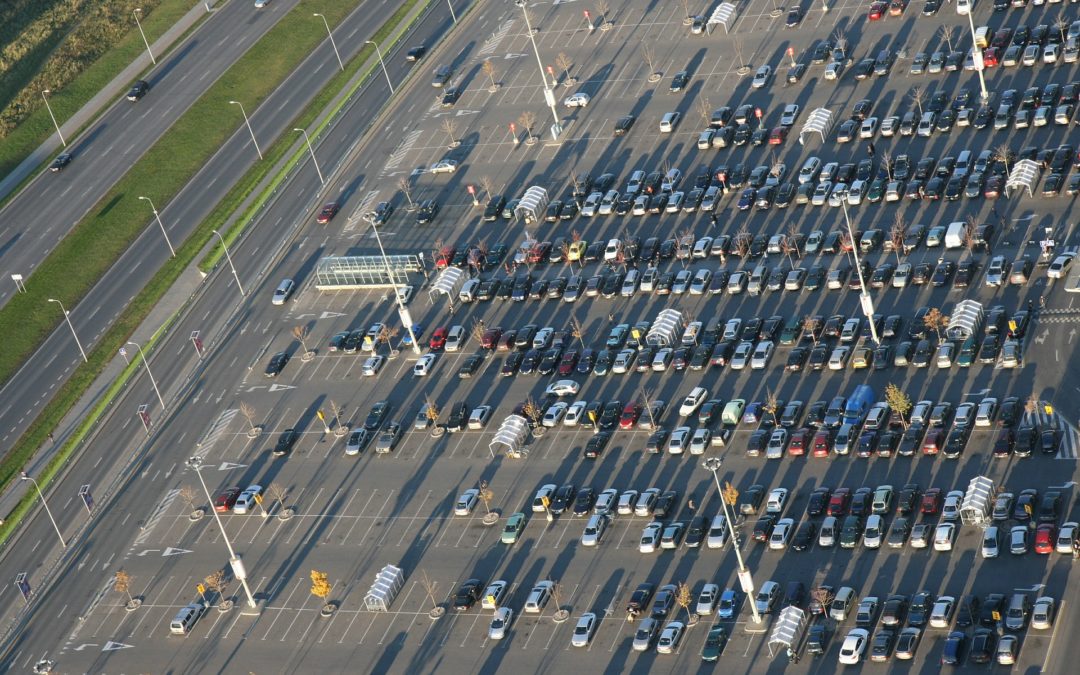

If there is a financial downturn, thousands of motorists could be left unable to pay for their cars. This could leave dealers with hard-to-sell used cars.

As many as 90% of new cars sell through finance deals. They are often called personal contract plans or PCPs.

This means customers pay monthly. In practice, they lease their cars, rather than buy them.

If the loans have been mis-sold, dealers could be liable to pay millions of pounds in compensation.

The Financial Conduct Authority (FCA) has launched an investigation into the motor finance industry. The FCA fears that some finance customers may be paying too much for credit.

The Authority will asses who uses finance and how the products are sold. It will also determine if sales staff carry out proper checks on customers. They need to make sure if they can afford the necessary monthly repayments.

The expectation is that the regulator will reveal whether actions can be taken soon.

It could mean tougher rules and fines for lenders who have sold car loans incorrectly.